Mistake: Relying On Rigid Input Forms. Solution: The Adaptive Intake Process (Ref: Slack)

We often make the mistake of assuming that if we build a robust, compliant process, our colleagues will naturally follow it. In the context of financial operations—specifically expense reporting and invoice submission—this assumption usually leads to a significant friction point.

As a Financial Controller, you likely have a precise set of requirements for every transaction: vendor name, VAT ID, category, project code, and the receipt image. The logical step is to create a form (using Airtable, Typeform, or your ERP’s portal) that makes every field mandatory to ensure data integrity.

However, I have observed that this is where user adoption collapses. When faced with a 15-field form, sales and marketing teams—who are focused on speed—will often delay submission or bypass the process entirely by emailing you directly. The result isn't better compliance; it is delayed closing cycles and "shadow data."

The mistake is forcing the user to structure the data for you. The solution is the Adaptive Intake Process.

The Problem: The Portal Fallacy

The "Portal Fallacy" is the belief that shifting the administrative burden to the submitter saves time for the finance team. While it theoretically reduces manual entry for the controller, it introduces "adoption drag."

If an employee has to log into a specific portal, find the right project code, and manually type out a VAT number from a PDF, they view the finance function as a blocker. This leads to late submissions, which kills real-time cash flow visibility.

The Solution: The Adaptive Intake Process

Instead of demanding structured data upfront, the Adaptive Intake Process accepts unstructured inputs (a forwarded email, a Slack message, a photo of a receipt) and uses automation to structure it before it reaches the ledger.

This approach leverages tools like Make or n8n to act as middleware, and Large Language Models (like GPT-4o or Claude 3.5 Sonnet) to handle the parsing. The goal is to lower the barrier to entry so significantly that submission becomes instantaneous.

Here is how you can architect this:

1. The Low-Friction Entry Point

Do not force users to leave their communication tools. Establish a webhook or a dedicated email alias (e.g., expenses@company.com) that triggers the automation.

- Channel: Slack/Teams Channel or Email Forwarding.

- Action: The user snaps a photo or forwards an invoice with a simple caption: "Lunch with Client X, Project Alpha."

2. The Semantic Structuring Layer

Once the unstructured data is received, the automation workflow sends the text and image to a multimodal LLM. Unlike traditional OCR which only reads text, the LLM allows for semantic understanding.

- Extraction: The model extracts the Date, Amount, Currency, and Vendor.

- Inference: Based on the caption ("Lunch with Client X"), the model infers the GL Category (Meals & Entertainment) and the Project Code (by matching "Project Alpha" against your active project list).

3. The Interactive Confirmation Loop

This is the critical "adoption" step. Instead of silently failing if data is missing, the system loops back to the user in the same channel.

If the confidence score is high, the system sends a Slack message: "Recorded: $50 at Starbucks for Project Alpha. Receipt attached. Reply 'Edit' to change, or nothing to approve."

If information is missing, it prompts specifically for that piece: "I captured the receipt, but which client was this for?"

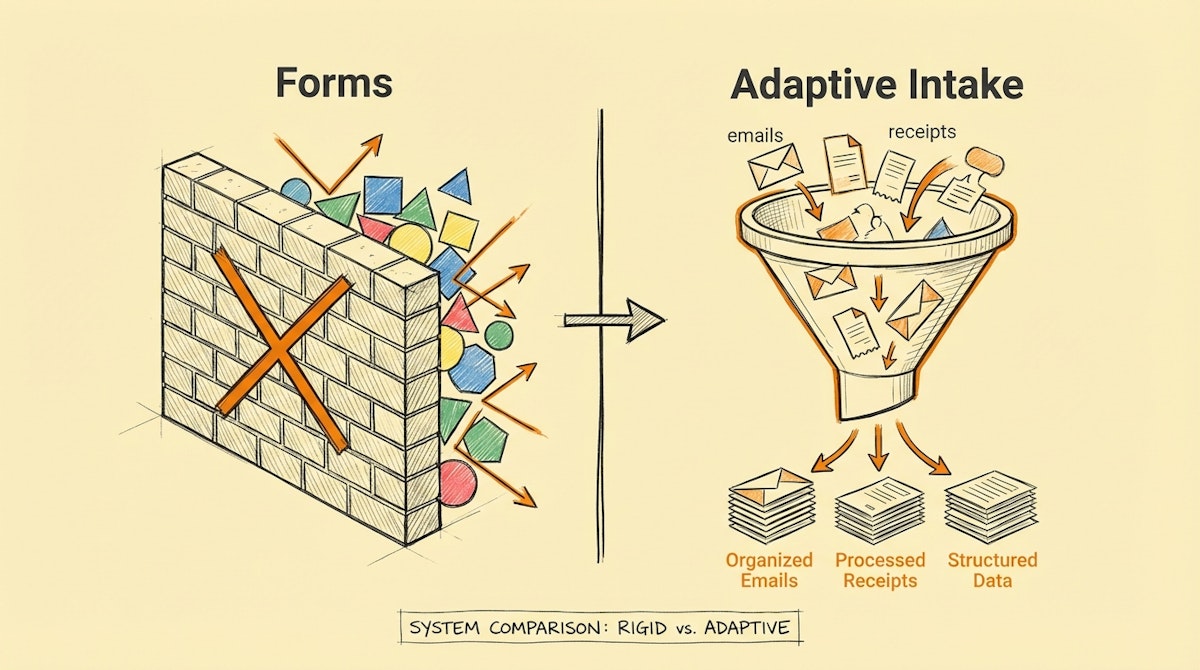

Comparison: Rigid Forms vs. Adaptive Intake

The following table outlines why shifting to an adaptive model improves governance by reducing friction.

| Metric | Rigid Input Forms | Adaptive Intake |

|---|---|---|

| User Action Required | Manual Data Entry | Upload & Confirm |

| Submission Speed | High Latency (Batching) | Real-Time (Streaming) |

| Data Integrity Risk | User Input Errors | AI Hallucination (Low) |

| Adoption Driver | Policy Enforcement | Convenience |

Implementation Notes

For a Financial Controller, reliability is paramount. To mitigate the risk of AI hallucination, you should treat the AI's output as a "Draft" state. The data should land in your ERP or Airtable with a status of Pending Review. This allows you to maintain control without forcing the entire organization to perform data entry.

Companies like Slack have championed this "meet the user where they are" philosophy, and newer fintech platforms like Brex represent this shift by automating the receipt matching process entirely via mobile interaction.

Conclusion

The non-obvious benefit of the Adaptive Intake Process is not just time saved; it is the psychological shift in how the organization views the finance team. By removing the friction of rigid forms, you transform from the "compliance police" into a strategic partner who makes operations invisible. When the barrier to submission drops to zero, compliance becomes the path of least resistance.

References

- Slack Workflow Builder

https://slack.com/features/workflow-automation - Brex Expense Management

https://www.brex.com/product/expense-management - Make (Automation Platform)

https://www.make.com