Contrarian: Rejecting Zero-Touch Finance For The Augmented Decision Process (Ref: Palantir)

We need to talk about the dangerous obsession with "Zero-Touch" automation in finance.

There is a prevailing narrative in the SaaS world—often pushed by aggressive vendor marketing—that the ultimate goal of a Financial Controller is to automate themselves out of a job. The pitch is always the same: configure the rules once, and let the invoices, expenses, and reconciliations flow straight into the ERP without human intervention.

I have observed that pursuing this level of autonomy is often a strategic mistake.

When we try to automate the decision (the approval, the final sign-off), we introduce fragility. We create "black boxes" where errors compound unnoticed until an audit reveals a disaster. In my experience, the highest ROI doesn't come from removing the human; it comes from supercharging the human context.

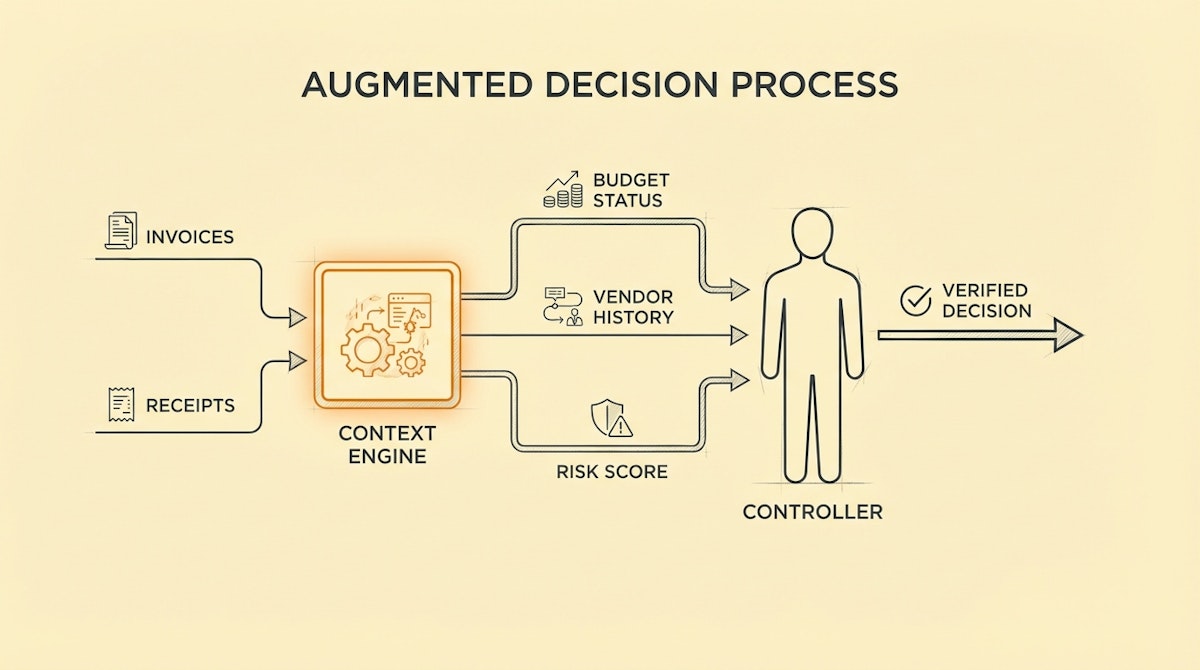

This follows the philosophy often championed by Palantir, specifically their approach to "Symbiosis." They argue that computers are good at processing data, but humans are essential for moral and nuanced judgment. In finance, this translates to a shift from Zero-Touch Automation to the Augmented Decision Process.

The Fallacy of Rule-Based Decision Making

Traditional automation relies on binary logic. If an invoice is under $500, approve it. If a vendor exists, pay them.

But financial reality is rarely binary.

- What if the vendor is valid, but the spending velocity has spiked 300% in a week?

- What if the GL code is technically correct, but the strategic budget allocation for that department changed yesterday?

- What if the invoice looks perfect but is a sophisticated deepfake?

"Zero-Touch" systems miss these nuances. By the time you notice the variance in the P&L, the cash is gone.

The Solution: The Augmented Decision Process

Instead of asking, "How can I automate this approval?" ask, "How can I automate the preparation for this approval?"

The goal is to present the Financial Controller with a "Draft State" that requires a simple, high-confidence verification. I call this Contextual Pre-Staging.

Here is how to structure this architecture using tools like Make (formerly Integromat) or n8n, combined with an LLM like Claude 3.5 Sonnet (which excels at document reasoning).

Phase 1: Aggregation & Extraction (The Robot's Job)

The automation triggers when a document arrives (e.g., an invoice in an inbox).

- Ingest: The file is captured.

- Extract: An LLM or OCR tool (like Nanonets or Document AI) extracts the line items, dates, and amounts.

Phase 2: Contextual Enrichment (The "Augmentation")

This is the step most teams miss. Do not just validate the data; enrich it. The automation should query your other systems:

- Budget Check: Check Airtable or Google Sheets for the current budget utilization of that department.

- Vendor History: Query the ERP (Xero/NetSuite/Quickbooks) to see the last 3 payments made to this vendor.

- Anomaly Detection: Use an LLM to compare the line items against the company policy (e.g., "Does this SaaS subscription include a 'Enterprise' markup not present in previous contracts?").

Phase 3: The Verified Handoff

Instead of posting to the ledger, the automation sends a rich notification to the Controller (via Slack, Microsoft Teams, or an email summary).

This notification contains:

- The PDF link.

- The extracted data.

- The Context: "Budget is at 85% utilization. This is 15% higher than the last invoice from this vendor. No policy violations detected."

- Action Buttons: [Approve & Post] or [Flag for Review].

Comparing Approaches

Below is a comparison of why keeping the human in the loop improves strategic alignment.

| Metric | Zero-Touch (Legacy Goal) | Augmented Decision (Strategic) |

|---|---|---|

| Primary Risk | False Positives (Bad data posted) | Decision Fatigue |

| Trust Level | Low (Requires constant audit) | High (Verified at entry) |

| Exception Handling | Breaks the workflow | Native to the workflow |

| Role of AI | The Decision Maker | The Analyst / Advisor |

Implementing The "Draft-First" Standard

To move toward this model, you need to change your definition of a successful automation. Success is not "No humans involved." Success is "No manual data entry involved."

The Technical Blueprint:

- Orchestrator: Use n8n (self-hosted is great for financial data privacy) or Make.

- Intelligence Layer: Use OpenAI GPT-4o or Claude 3.5 Sonnet to analyze the text of the invoice against a text-based system prompt of your procurement policy.

- Interface: Use Slack Block Kit to send the summary. This allows you to approve directly from the notification channel without logging into the accounting software.

Conclusion

The Financial Controller's value is not in typing data; it is in ensuring the integrity of the financial narrative. By moving to an Augmented Decision Process, you aren't just saving time—you are building a defense layer that scales.

Don't automate the judgment. Automate the context required to make that judgment instantly.