Automating Reconciliation: The Immutable Audit-Log Synchronization Process

The Context: When Volume Outpaces Verification

In any scaling organization, there is a tipping point where the volume of transactions breaks the manual reconciliation process. For a long time, manual exports and VLOOKUPs in Excel are sufficient. But as we scaled our B2C operations, the sheer number of small-ticket transactions created a data throughput that a fixed-size finance team simply couldn't audit manually without delaying the month-end close significantly.

The friction wasn't just about time; it was about trust. The financial controllers were hesitant to approve automations that interacted directly with the general ledger because if a script runs wild, it creates a mess that takes ten times longer to clean up than to do manually. The goal wasn't just to automate the data entry; it was to automate the governance.

The Challenge: The "Black Box" Anxiety

For a Financial Controller, an automated system often looks like a "black box." Data goes in, and accounting entries come out, but the audit trail is often opaque. Our specific challenge involved reconciling Stripe payments against our internal CRM data before pushing verified revenue recognition into the accounting software.

The requirements were strict:

- Zero Drift: Every cent processed in the payment gateway had to match an invoice ID in the internal system.

- Exception Handling: If a match wasn't found, the automation had to pause and flag it for human review, rather than guessing or failing silently.

- Auditability: Every step needed a timestamped log accessible without code.

The Solution: The Immutable Audit-Log Synchronization Process

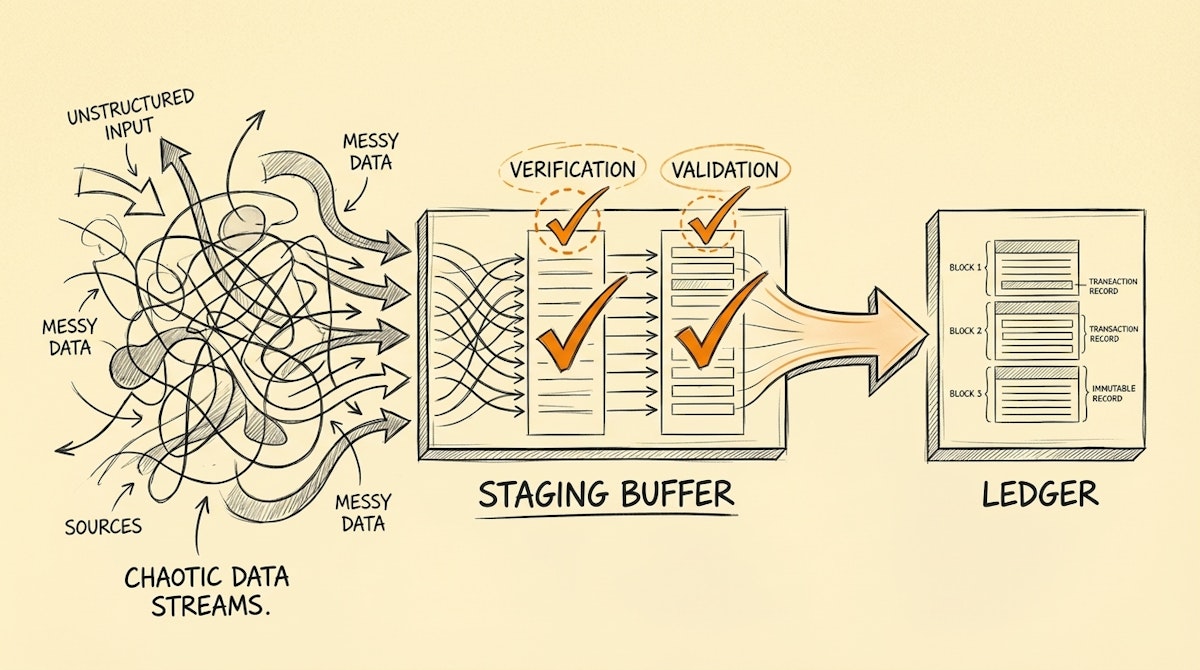

To solve this, we moved away from direct point-to-point automation (e.g., Stripe directly to Pennylane) and implemented a middleware architecture I call The Immutable Audit-Log Synchronization Process. This approach uses Airtable as a staging database and Make as the orchestration engine.

Here is the technical breakdown of how we structured the workflow.

Phase 1: The Staging Buffer (Airtable)

Instead of writing directly to the accounting software, all transaction data is first dumped into an Airtable base. We structured the base with three primary tables:

- Raw Ledger: Incoming bank/Stripe feeds.

- Internal Records: Invoices generated by the CRM.

- Reconciliation Log: The junction table where matches occur.

This "Staging Buffer" allows the finance team to view the data before it becomes official accounting records. It acts as a safety valve.

Phase 2: The Matching Logic (Make)

We configured a Make scenario to run on a schedule (every 4 hours) rather than instantaneously. This batch processing reduces API load and allows for easier debugging.

- Ingestion: Make fetches the last 4 hours of transactions from the payment gateway.

- Search & Compare: The scenario iterates through the transactions and searches the Airtable "Internal Records" for a matching Reference ID.

- The Logic Branch:

- If Match Found: It creates a record in the "Reconciliation Log" linking the two sources and marks the status as "Verified."

- If No Match: It creates a record in the "Reconciliation Log" but marks the status as "Flagged for Review" and sends a Slack alert to the Ops team.

Phase 3: The Immutable Write

Only records marked as "Verified" in Airtable trigger the final Make scenario, which pushes the clean data into the accounting ERP. This ensures that no dirty data ever enters the financial system of record.

The Results

Implementing this architecture changed the dynamic between the tech team and the finance department. We moved from a relationship of friction to one of collaboration.

- 90% Reduction in Review Time: The finance team now only looks at the "Flagged for Review" view in Airtable, which represents usually less than 1% of total transactions. The other 99% process automatically.

- Real-time Audit Trail: The "Reconciliation Log" serves as a permanent, searchable history of exactly when a transaction was cleared and by which process.

- Scalability: We handled a 3x spike in volume during a Q4 promotional period without adding any headcount to the finance team.

Conclusion

Automation in finance is not about speed; it is about safety. By introducing a staging layer and a dedicated audit process within the automation itself, we gain the speed of robots with the governance of a strict auditor. The key lesson here is to never automate the action without also automating the verification.

References